Almost all nations miss UN deadline for new climate targets (France 24)

Majority of Countries Miss Deadline for Updated NDCs (Climate Action)

Risk of breach of 1.5C of global warming here sooner than expected, studies find (Carbon Brief)

The climate is warming and sea levels rising way faster than governments are acting (Climate Action Tracker)

Maersk: New U.S. Tariffs and Red Sea Crisis Shaping Global Maritime Trade in Early 2025 (GCaptain)

Tariffs: Their Unintended Consequences, and How to Respond (Supply Chain Brain)

Global investment into energy transition exceeded USD 2 trn (The Global Energy Association)

Top 10 Ship Building Countries In The World (Marine Insight)

India’s $3 Billion ‘Strategic Push’ For Shipbuilding: With Tax Breaks, Policy Reforms & Key Incentives, Can India Invigorate Its Industry? (EurAsian Times)

The Circularity Factor: Creating value on the journey to Net Zero (Carbon Trust)

Circularity in the built environment: Unlocking opportunities in retrofits (McKinsey)

IKEA gets praise for shipping decarbonization efforts (Safety4Sea)

Supply Chain Management (SCM) Software Market to Grow by USD 24.87 Billion from 2025-2029, Driven by Supply Chain Visibility and Event Management, with AI Impact (Yahoo Finance)

Top 6 energy investment themes in 2025 (S&P Global)

Hearings Focuses on Improving America’s Maritime Infrastructure, Shipbuilding, and Competitiveness (Transporation and Infrastructure)

SHIPS for America – can the US really rebuild its maritime industries? (Seatrade-Maritime)

The future of maritime careers: Adapting to digitalization and decarbonization (Safety4Sea)

IONATE Raises $17 Million to Help Grids Meet Decarbonization and AI Needs (ESG Today)

Wartsila CEO says US energy transition will continue despite Trump (Reuters)

The idea that “globalization is dead” is no longer an exaggeration but a reality. As early as the early 2000s, analysts at ANBOUND Think Tank predicted that the world would become increasingly fragmented and regionalized. This has now materialized, influenced by major events such as:

Historically, multinational corporations thrived in a globalized world, prioritizing profit maximization and utilizing low-cost labor in developing countries. The post-Cold War period until the 2008 financial crisis was a golden era for global supply chains, where companies benefited from seamless international trade and reduced political barriers. However, today’s world is vastly different—geopolitical risks, economic nationalism, and regional conflicts now dictate global production and trade decisions.

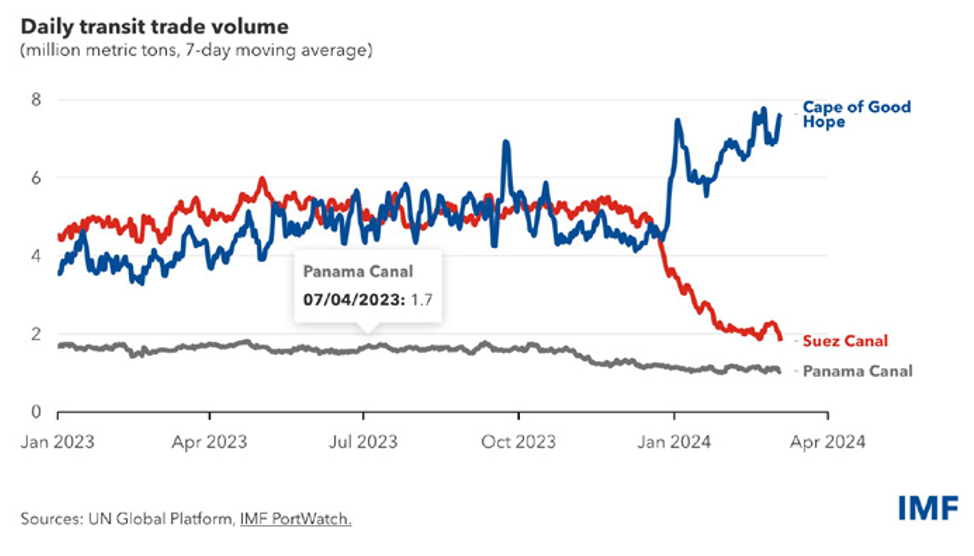

Geopolitical instability is increasing operational costs for multinational corporations. For example, the Red Sea crisis caused by the Israel-Hamas conflict has forced shipping companies to choose between:

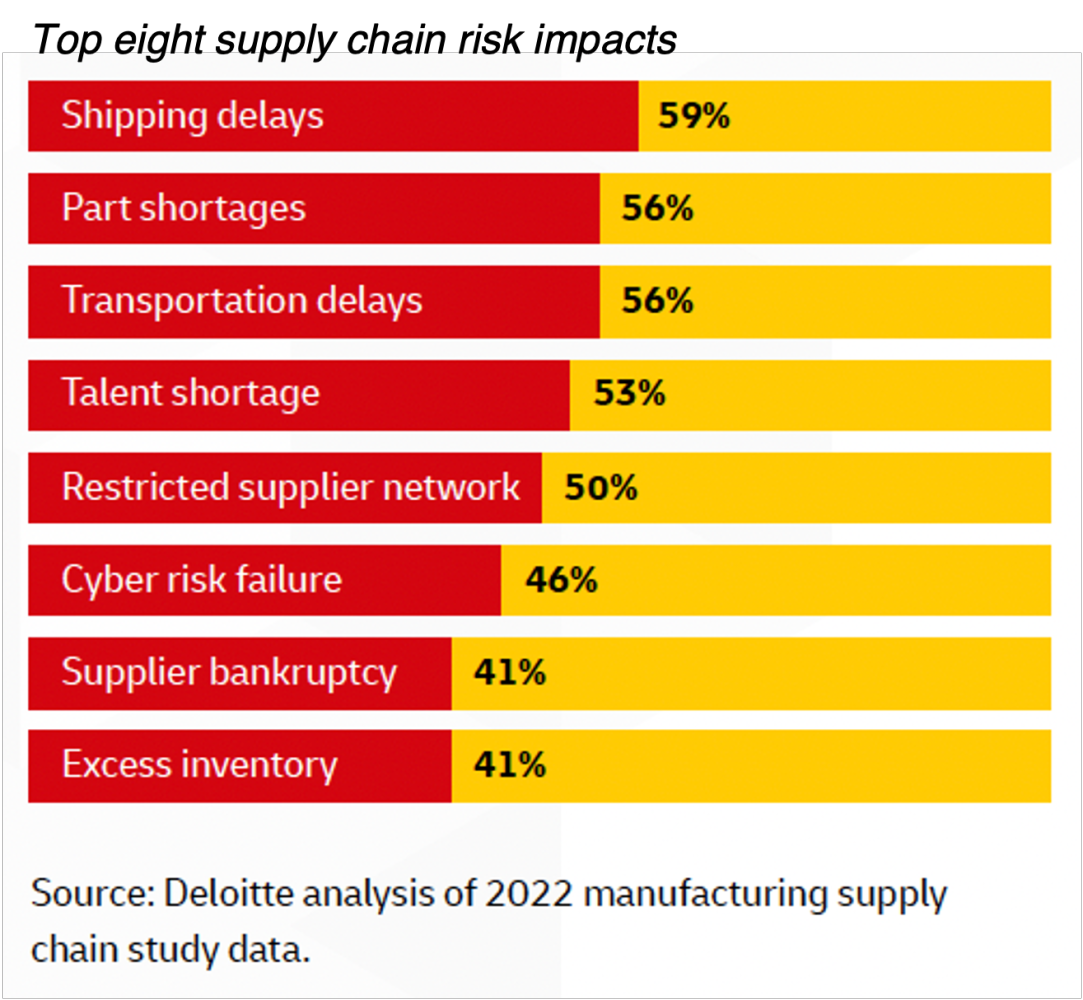

Both options increase costs, ultimately affecting consumers. As a result, traditional global supply chain models are no longer viable, forcing companies to rethink their production strategies.

Even business schools acknowledge that classic economic theories, which emphasize global cost efficiency, are becoming obsolete. Today, companies must prioritize resilience over pure profit by restructuring production based on regional stability, political risk, and logistics security.

The transformation of multinational production is no longer just about corporate decisions but also about spatial and geopolitical considerations. Transaction costs now include geopolitical risks, which significantly impact overall business expenses. Companies that fail to balance profit-seeking with risk management will struggle to sustain long-term operations in this new era of de-globalization.

This shift underscores the increasing importance of regionalized production models and the need for companies to adapt to a fragmented global economic landscape.

Based on tracking research and analysis of global trade trends, researchers believe that there will be three significant changes in supply chains:

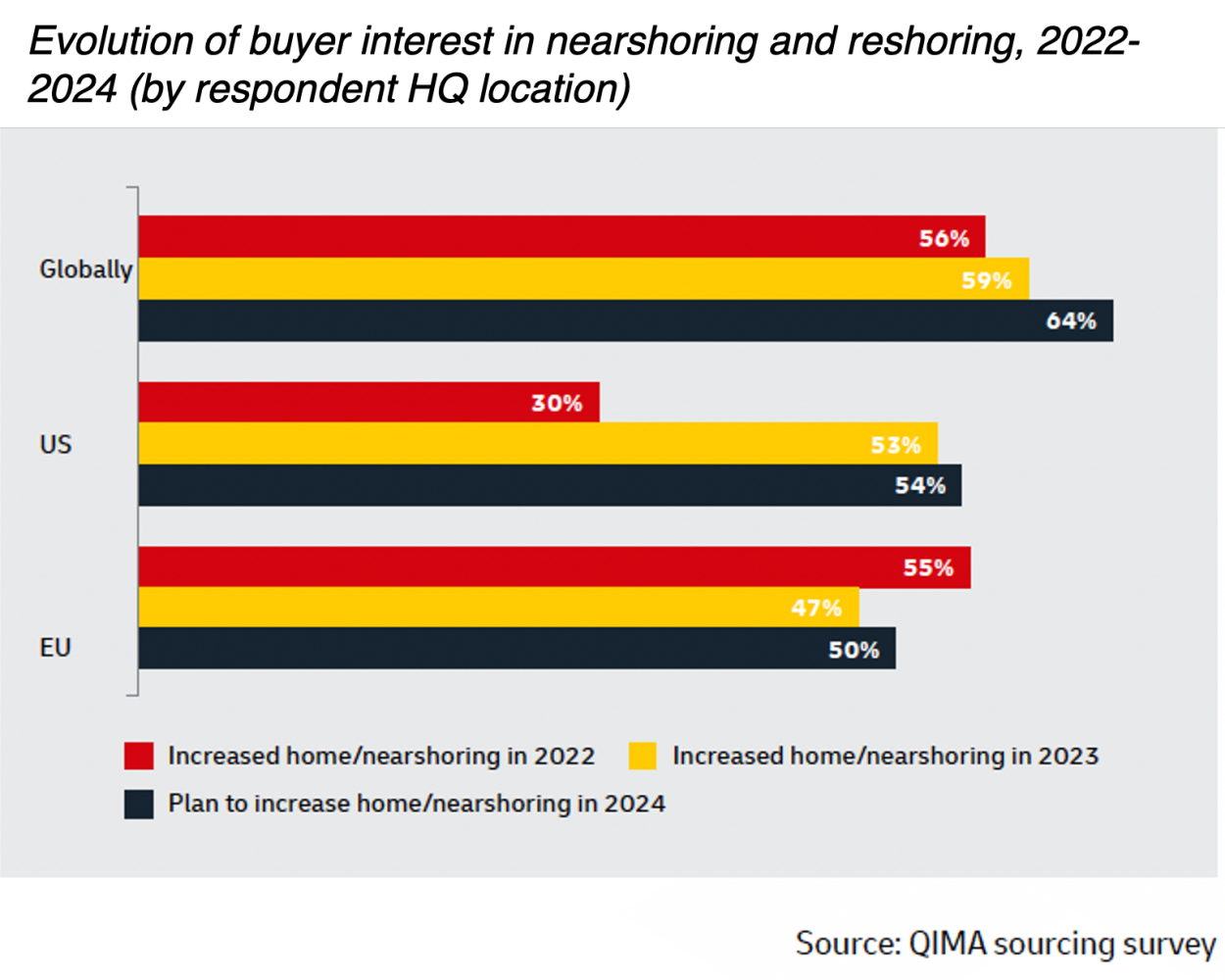

1. Shorter Supply Chains—Long supply chains introduce higher risks and uncertainties in the current geopolitical and geoeconomic landscape. As a result, companies are prioritizing security and stability over cost, leading to shortened supply chains as a key restructuring trend.

2. Regionalized Supply Chains—Disruptions and market distance create new risks, including potential order losses due to supply chain uncertainty. To mitigate these challenges, companies are regionalizing their supply networks and forming localized and distributed supply chain systems to better serve regional markets.

3. Selective Supply Chains—Once driven primarily by business efficiency, supply chains are now heavily influenced by geopolitics, national security, alliances, values, and human rights. Future supply chains will likely become more selective, shaped by political and ideological factors rather than purely economic considerations.

Since the Obama administration, the U.S. has promoted nearshoring (relocating production closer to domestic markets) and friendshoring (building supply chains in allied nations). These strategies are designed to:

Despite U.S. efforts to reduce reliance on China, Chinese capital remains deeply embedded in global supply chains. Research presented at the 2023 Federal Reserve Bank of Kansas City’s Jackson Hole meeting suggests that while U.S. dependence on China has become less direct, it has not disappeared. Some analysts argue that complete “decoupling” or “de-risking” is unlikely, and the West will struggle to fully break free from Chinese supply chains.

The Close Produce Model in Global Manufacturing refers to a strategic approach where major component industries are deployed around central markets and key productivity hubs.

This model, introduced by the Chinese think tank ANBOUND in 2022, aligns with the evolving global economic landscape, where companies must navigate rising costs, geopolitical risks, and shifting market dynamics.

Instead of viewing supply chain shifts solely as nearshoring or friendshoring, Close Produce integrates aspects of both while recognizing the complexity and diversification of modern supply networks.

The model represents a shift in multinational corporations’ priorities from pure profit-seeking to a strategic approach centered on technology, capital, and consumption to optimize production and operational costs, prioritizing spatial proximity and social-environmental alignment to create an integrated and efficient production system. While supply chain layouts in the future will still prioritize “profit”, “resilience” will be even more important.

This shift can be interpreted as a form of economic decoupling from China, driven by internal strategic adjustments. While some Chinese companies are also adopting regionalized production models to expand globally, geopolitical tensions—particularly between the U.S. and China—pose significant risks to their overseas growth.

However, this “Close Produce” approach serves as a macro tool for analyzing how industries restructure amid the ongoing transformation of global trade.

1. Technology as a Core Factor to Reduce Monopoly Costs

Advanced technology is essential for enhancing production efficiency and product quality. However, global technology monopolization is increasing, limiting access to high-tech innovations. High-tech products tend to be concentrated in certain countries, creating barriers for others. For example, the semiconductor industry remains dominated by a few firms controlling critical components. To remain competitive, multinational companies must invest in R&D, form strategic partnerships with technology hubs, and minimize dependency on monopolized technologies.

2. Capital Allocation to Reduce Financing Costs

Access to diverse financial resources, including stock and bond markets, is crucial for expansion, innovation, and stability. However, global capital flows have become more concentrated due to shifting geopolitical and economic conditions. The U.S. leads in market capitalization, followed by China, Japan, and Europe, but capital flows are shrinking, making financing more complex. Companies must align with emerging capital trends and strategically position themselves to secure lower-cost funding.

3. Proximity to Consumption Centers to Reduce Logistics Costs

Locating production near key consumer markets improves efficiency, market responsiveness, and cost control. With rising shipping costs due to geopolitical conflicts, security risks, and labor expenses, logistics costs have become a major factor in supply chain decisions. Companies like Maersk report increased profits despite continued disruptions in shipping routes like the Red Sea. Multinational firms must adapt by setting up operations closer to demand centers, reducing reliance on vulnerable trade routes.

1. Ideological and Political Considerations

2. Market Order and Legal Consistency

3. Logistics Cost Optimization

4. Shifts in Production Costs

In addition, several other factors play a crucial role in companies’ decision-making, such as:

However, with careful planning, adopting the Close Produce approach can provide companies with more resilient, efficient, and sustainable production systems that are better equipped to navigate the complexities of today’s global economy.

Application: The shift toward electric vehicles (EVs) has intensified the need for regionalized supply chains to ensure that battery production, component sourcing, and final assembly are close to key markets. Example:

Application: The production of chips and electronic components is shifting closer to key markets due to geopolitical tensions, supply chain risks, and national security concerns. Example:

Application: Retailers are rethinking fast fashion and e-commerce fulfillment by producing closer to consumer markets to enable faster turnaround times and reduce environmental impact. Example:

Application: The COVID-19 pandemic exposed vulnerabilities in global pharma supply chains, pushing for localized production of critical medicines and medical devices. Example:

Application: Ports, logistics, and heavy industry require close coordination between manufacturers, suppliers, and distribution hubs. Example:

The Close Produce Model signals a transformation in global supply chains, moving away from cost-driven outsourcing to localized, resilient, and technology-driven production networks. Companies must reorganize and realign their global operations, leveraging automation, proximity to markets, and strategic financial positioning to maintain competitiveness. This shift will likely influence capital markets, trade policies, and technological investments worldwide.

Beatriz Canamary is a consultant in Sustainable and Resilient Business, Doctor and Professor in Business, Civil Engineer, specialized in Mergers and Acquisitions from the Harvard Business School, and mom of triplets. Today she is dedicated to the effective application of the UN Sustainable Development Goals in Multinationals.

She is an ESG enthusiast and makes it possible to carry out sustainable projects, such as energy transition and net-zero carbon emissions. She has +15 years of expertise in large infrastructure projects.

Member of the World Economic Forum, Academy of International Business and Academy of Economics and Finance.