For those of us in the maritime industry, supply chain, and sustainability sectors, recent headlines about the 90-day tariff pause between the United States and China are more than just trade news—they are a case study in system dynamics, geopolitical maneuvering, and market behavior.

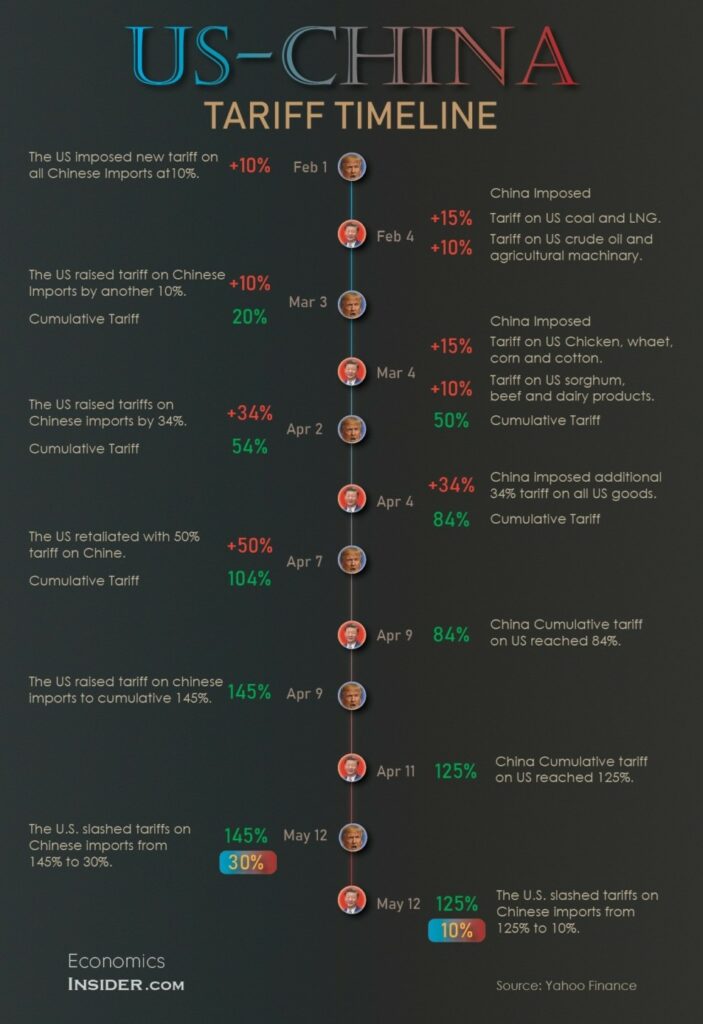

After months of escalating tariffs—reaching as high as 145% on Chinese goods and 125% on U.S. exports—the announcement of a mutual tariff rollback came as both a surprise and a strategic relief for global shippers, traders, and logistics providers.

But let’s be clear: this is not a solution. It’s a pause—and pausing doesn’t mean the game is over.

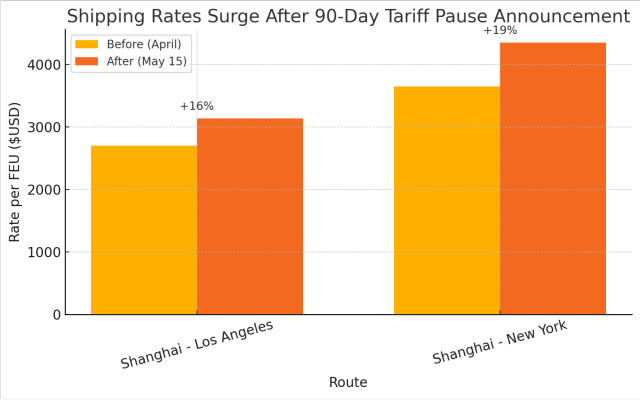

Within 48 hours of the announcement, booking platforms reported a flood of spot cargo orders as companies scrambled to take advantage of the temporary tariff window. According to gCaptain, shipping rates skyrocketed almost overnight, with some carriers posting rate hikes of $2,000 to $3,000 per FEU.

The Shanghai Containerized Freight Index (SCFI) confirmed a sharp jump:

Carriers like COSCO, CMA CGM, Hapag-Lloyd, and Evergreen reacted quickly, layering two consecutive rate increases—one in May and another planned for June. This surge reveals just how sensitive shipping economics are to trade policy shifts.

Meanwhile, WTI crude oil climbed 12% in just seven days on renewed hopes of higher industrial and transport activity driven by the tariff truce (FX Leaders)—a signal that this isn’t just a container shipping story but a ripple effect across energy markets and commodities.

Several experts, including Al Jazeera’s trade analysts, have questioned whether this move signals a strategic retreat by the United States, citing domestic inflation pressures, election-year politics, and supply chain vulnerabilities.

While the official line emphasizes mutual economic benefit, some commentators argue the U.S. needed this deal more than China, particularly to stabilize key import sectors like electronics, automotive components, and consumer goods ahead of peak retail season. Others argue that this tariff de-escalation benefits China just as much—if not more.

China’s export numbers have been weakening for months, with a 21% drop in exports to the U.S. in April alone, according to several trade reports. Domestic overcapacity, declining demand from Western markets, and deflationary pressures have placed significant strain on China’s manufacturing-heavy economy.

By securing a 90-day window to clear inventory, stabilize factory activity, and keep ports moving, China may have strategically bought time to cushion its own economic slowdown. Some experts even suggest that this temporary reprieve helps China reposition itself with other trade partners, strengthening relationships across BRICS+ countries and the Global South while maintaining access to the lucrative U.S. consumer market.

In this light, both sides could be seen as leveraging the pause to manage domestic pressures, reduce economic volatility, and position themselves for the next round of negotiations.

What’s clear is that neither side can afford a complete decoupling, at least not yet. The 90-day truce isn’t a sign of weakness or victory for either party—it’s a tactical reset in a long-term, high-stakes negotiation.

This moment feels familiar. The early 2000s saw China’s accession to the World Trade Organization, triggering what economists later termed the “China Shock”—a massive realignment of global supply chains that devastated some U.S. manufacturing sectors while lowering prices for consumers globally.

Today’s tariff pause hints at a reverse shock risk. By temporarily loosening the pressure valve, both nations have signaled their interdependence, but they haven’t resolved their structural competition over technology leadership, energy dominance, and market control.

Supply chain leaders must read between the lines and prepare beyond the 90-day window. Here are four strategic imperatives:

This pause may accelerate long-term shifts already underway:

With transit times of 22–30 days on trans-Pacific routes, the logistics window is even shorter than it seems. Importers are already racing to land cargo before the clock runs out.

As Raymond James analysts put it, this temporary boost may “pull demand forward”, leading to a sharp post-truce decline if no permanent resolution is reached.

This is not just about tariffs. It’s about how resilient, diversified, and intelligent your supply chain strategies are in a world where policy shifts can flip market dynamics overnight.

The companies that treat this as a warning shot, not a victory lap, will be the ones better positioned when the next disruption comes—not if, but when.

Stay informed and proactive. In today’s volatile trade environment, adaptability and resilience are not just advantages—they are necessities

I’ve spent the past 18+ years helping ports, supply chains, and global businesses turn sustainability goals into real, measurable results.

From leading billion-dollar infrastructure projects to building my own consulting firm, I’ve seen how the right strategy can turn pressure into opportunity.

My mission today is simple: help leaders like you build sustainable, future-ready businesses that don’t just check boxes—but actually make an impact. One decision, one project, one team at a time.

Let’s build what’s next—together.

Have a project or idea in mind?

I’d love to hear what you’re working on.

Book a quick call here